AI agents are set to usher in a productivity boon for every company that fully leverages it. Here’s why!

| From the desk of Miles Everson: Hello! I’m excited to talk about another investing insight for today’s “The Independent Investor.” Every Wednesday, I talk about investing insights and strategies in the hopes of helping you attain financial freedom through this activity. Today, let’s tackle why artificial intelligence (AI) agents are the next big thing in the world of AI. Do you want to know more? Keep reading below! |

AI agents are set to usher in a productivity boon for every company that fully leverages it. Here’s why! AI, for the most part, has often been thought of as tools used to help with basic research or repetitive tasks. That assumption is true to an extent, as tools like ChatGPT are useful at pulling data, drafting documents, and organizing information. However, did you know that AI agents—a software system capable of performing tasks on behalf of others—exist? These AI agents are capable of handling high-stakes, complex tasks autonomously, putting them in a position where they can drastically reshape industries and drive the next wave of market growth. Enhancing Efficiency We’ve been seeing AI agents crop up lately. For example, BlackRock ’s Aladdin platform has been making waves in the financial markets as it doesn’t just help manage portfolios, but it also takes on complex tasks like risk analysis and the creation of investment strategies.

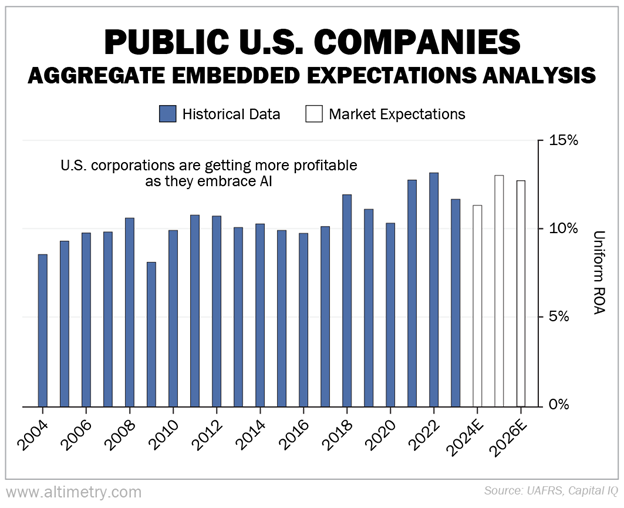

In an industry as complex as finance, having an AI agent brings a productivity boost that an AI assistant could only dream of doing. You see, while you can ask an AI tool like ChatGPT to find companies that made big acquisitions in the last quarter, you’ll still have to manually adjust for underreported revenue or inflated asset values—a slow and labor-intensive process. On the other hand, an AI agent could take care of all those adjustments for you, as it can comb through financial statements, make the necessary calculations, and hand you the final output. When leveraged to its maximum potential, an AI agent can help you review 20 companies in the same amount of time that it would take to review 2 companies manually. In sales, AI agents are an even bigger game changer, as they have the ability to not only find leads but craft personalized emails, send follow-ups, and even schedule meetings. All a salesperson has to do is handle the final conversation. Simply said, this kind of automation can bring about a dramatic boost to individual and team effectiveness, helping companies grow and scale faster than ever before. The Benefits of Investing in AI-powered Solutions Microsoft , a company that has shifted its focus towards AI, has been an early adopter of AI solutions. The company has nearly doubled its profits and revenue since 2019 due to its commitment to invest in AI. During that period, its operating profits from its AI-focused intelligent cloud division have jumped from USD 14 billion to USD 50 billion. According to Professor Joel Litman , Chairman and CEO of Valens Research and Chief Investment Officer of Altimetry Financial Research , Microsoft isn’t the only company that’s seeing the benefits of AI, as this trend is taking place across the market. Professor Litman and his team saw this through their aggregate Embedded Expectation Analysis (EEA) framework. By using this tool, they start with the average stock price of all publicly traded U.S. companies. From there, they can calculate what the market expects from future cash flows. Finally, they then compare that with their own cash flow projections. In other words, the EEA framework tells Professor Litman and his team how well U.S. companies have to perform in the future to be worth what the market is paying for them today. Uniform return on assets (ROA) hit record highs in 2022, partly because of AI advancements. … and as AI improves productivity throughout the market, investors expect returns to reach 13% levels again by 2025.

As more companies follow in Microsoft’s footsteps, the market expects productivity to improve. This, in turn, will lead investors to price in these efficiency gains, justifying higher valuations across the board. The key takeaway from this? The rise of AI agents represents a monumental shift in how industries operate and how value will be generated. Companies that fully leverage AI agents will carve up a dominant position in the market in the years to come. That’s why as an investor, you need to look out for companies that fully embrace AI agents, as they will be setting themselves up for higher productivity and value generation. This will then lead to better returns… provided you invested in these types of companies. Hope you’ve found this week’s insights interesting and helpful. EXCITING NEWS AHEAD The world of work has shifted, and there’s no going back. The barriers to entry have never been lower for talented professionals to work independently, and today’s massive external workforce is hardly a pandemic-produced fad. Business owners can only survive in the new work landscape by partnering with this deep talent pool. With decades of experience in both small-business entrepreneurship and executive management at PwC, I truly believe that the future of work is independent. With that, I’m happy to share with you that my book, co-authored with Walter Scott Lamb, is now available on Amazon! Free Birds Revolution: The Future of Work & The Independent Mind This new bestseller is an essential read for both independent professionals and corporate executives. Here, we provide educational and practical guides to unpack the ever-growing workforce and offer you crucial ways to become a client of choice. Click on the link above to order your copy. Let this bestselling book help you future-proof your career and organization in the new world of work. Stay tuned for next Wednesday’s The Independent Investor! Even the greatest minds in finance didn't start as experts in the field… Learn more about Jim Simons’ system for work and life in next week’s article! |

Miles Everson

CEO of MBO Partners and former Global Advisory and Consulting CEO at PwC, Everson has worked with many of the world's largest and most prominent organizations, specializing in executive management. He helps companies balance growth, reduce risk, maximize return, and excel in strategic business priorities.

He is a sought-after public speaker and contributor and has been a case study for success from Harvard Business School.

Everson is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants and Minnesota Society of Certified Public Accountants. He graduated from St. Cloud State University with a B.S. in Accounting.