Here's why gold ISN'T your "golden ticket" to accumulating financial wealth…

| From the desk of Miles Everson: Hi! I hope you’re all having a great Wednesday so far. In today’s article, I’m excited to share with you a useful investment insight. I believe this is something we all have to keep in especially in our investment strategies during turbulent times. Ready to know more? Continue reading below. |

Here's why gold ISN'T your "golden ticket" to accumulating financial wealth… For centuries, investors have sought safety in assets that promise stability during turbulent economic periods. One example of that? Gold . The allure of this metal as a defensive investment has persisted through economic cycles, wars, and financial crises. However, when looking at the numbers, you might find that the traditional view of gold’s superiority may not be as strong as it appears.

Gold: Forget Me or Forget Me Not? In August 2024, the financial world was abuzz with speculation about the Federal Reserve’s impending rate cuts. Many experts expected the cuts to begin in September of the same year, leading to a weakening U.S. dollar. During this time, gold soared to unprecedented levels, surpassing USD 2,550 per ounce for the first time. This milestone reignited the long-standing debate: Gold versus stocks . While gold is often perceived as a haven during economic downturns, a closer examination reveals that equities, particularly those with dividends, may provide superior returns. Professor Joel Litman , Chairman and CEO of Valens Research and Chief Investment Officer of Altimetry Financial Research , challenges the prevailing notion that gold consistently outperforms equities during uncertain times. He points out that many investors compare gold’s performance to the S&P 500 based solely on price appreciation. However, this approach overlooks a crucial factor: Dividends . Unlike stocks, gold does not generate cash flow or dividends. It remains static in value unless its price rises due to external market forces. On the other hand, equities offer multiple avenues for wealth creation. Companies not only appreciate in value, but they also distribute earnings through dividends. Investors who reinvest these dividends benefit from compounding growth over time. To illustrate this point, Professor Litman highlights Altria (MO) , one of the world’s leading tobacco companies.

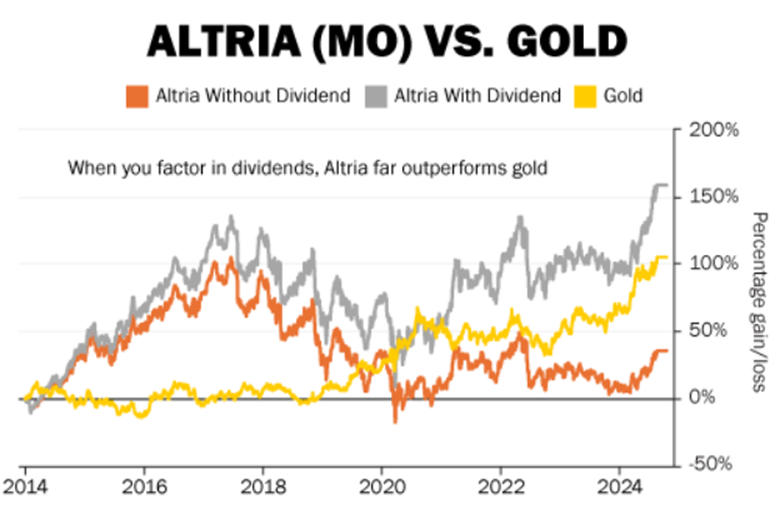

Based solely on its 2024 stock price appreciation, Altria’s performance since 2014 appears modest, with a 50% increase. Here’s the thing: When factoring in reinvested dividends, the total return exceeds 150% over the same period. Take a look below…

Comparatively, gold appreciated approximately 100% during this timeframe. This example underscores how dividend-paying stocks can significantly outperform gold when total return is considered. What’s more? This trend extends across the broader S&P 500! Many companies within the index consistently pay dividends, allowing investors to reinvest and amplify their gains. In contrast, gold offers no such advantage—it remains a static asset, unable to generate additional income or compound growth. Dividend-Paying Stocks are Your “Golden Ticket” Professor Litman emphasizes that for investors seeking stability during economic uncertainty, dividend-paying stocks present a compelling alternative to gold. You don’t want that, do you? Professor Litman points out that this isn’t a task for interns or IT personnel alone. Leaders themselves—especially managers—need to engage in mapping. After all, these companies provide defensive qualities similar to gold while also delivering tangible financial benefits. … and unlike gold, which remains inert, dividend stocks not only preserve capital but actively enhance it through consistent payouts and reinvestment opportunities. — In essence, gold is a store of value, but it does NOT grow. Equities, particularly those with strong dividend histories, provide dynamic opportunities for wealth accumulation. The bottom line? As economic cycles shift and financial landscapes evolve, prioritizing compounding returns through equities may put you and your investments in a far stronger position than those who simply hold onto gold. EXCITING NEWS AHEAD The world of work has shifted, and there’s no going back. The barriers to entry have never been lower for talented professionals to work independently, and today’s massive external workforce is hardly a pandemic-produced fad. Business owners can only survive in the new work landscape by partnering with this deep talent pool. With decades of experience in both small-business entrepreneurship and executive management at PwC, I truly believe that the future of work is independent. With that, I’m happy to share with you that my book, co-authored with Walter Scott Lamb, is now available on Amazon! Free Birds Revolution: The Future of Work & The Independent Mind This new bestseller is an essential read for both independent professionals and corporate executives. Here, we provide educational and practical guides to unpack the ever-growing workforce and offer you crucial ways to become a client of choice. Click on the link above to order your copy. Let this bestselling book help you future-proof your career and organization in the new world of work. Stay tuned for next Wednesday’s The Independent Investor! This fund made a name for itself by “solving” the market instead of beating it! Learn more about this fund and why talent engagement matters in next week’s article! |

Miles Everson

CEO of MBO Partners and former Global Advisory and Consulting CEO at PwC, Everson has worked with many of the world's largest and most prominent organizations, specializing in executive management. He helps companies balance growth, reduce risk, maximize return, and excel in strategic business priorities.

He is a sought-after public speaker and contributor and has been a case study for success from Harvard Business School.

Everson is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants and Minnesota Society of Certified Public Accountants. He graduated from St. Cloud State University with a B.S. in Accounting.