Breaking records isn’t always a good thing… especially when consumer debt is involved.

| From the desk of Miles Everson: Happy midweek! I’m thrilled to talk about another investing insight for today’s “The Independent Investor.” Every Wednesday, I tackle investing insights and strategies in the hopes of helping you attain financial freedom through this activity. Today, let’s talk about rampant consumer spending and its negative impact on the economy. Ready to know more? Continue reading below! |

|

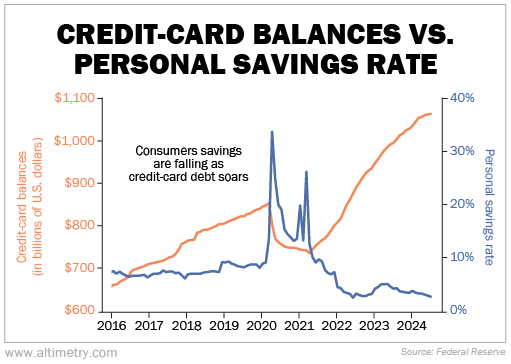

Breaking records isn’t always a good thing… especially when consumer debt is involved. As of Q4 2024, the credit card balances of Americans have soared to a whopping USD 1.21 trillion. To make things worse, the average credit card rate stands at 24.20% as of March 2025. While it’s easy to point to interest rates as the culprit for these alarming numbers, there’s actually another reason for soaring consumer debt: Consumer spending . While increased consumer spending is often seen as a positive signal, it can also add more pressure on the economy by way of ballooning consumer debt. You see, credit card debt has been on a rollercoaster ride for the past few years. In February 2020, it stood at USD 850 billion then dropped to below USD 750 billion by April 2021. Fast forward to today, spending has surged with a passion, with credit card debt up more than 52% since the 2021 low. The Downside of Stimulus-Backed Consumer Spending To support the pandemic-stricken economy, the U.S. government provided USD 4.6 trillion in stimulus checks to help Americans cope with their expenses and keep money in their bank accounts.

As a result of this decision, the personal savings rate went up like a rocket ship. Then, the U.S. and the rest of world reopened borders and soon enough, consumers ramped up their spending toward industries like travel, restaurants, retail and luxury goods. All of this pent-up desire to spend no doubt benefitted the economy. However, the magnitude of that spending spree can only last for so long. Since the start of 2022, personal savings rates have been on a decline, mirroring levels that were seen before the Great Recession. To make things worse, credit card debt is back with a vengeance as balances have reached all-time highs as of 2024.

If folks have less money saved up, they won’t be able to spend as much on non-necessities… and this will impact companies that sell these types of consumer goods. Murky Economic Outlook While inflation has shown signs of cooling after years on the rise, the personal savings rate is at 4.6%, which is significantly lower than the long-term average of 8.42%. This isn’t a good look since lower savings means consumers only have enough to get by. … and since consumer spending is one of the main drivers of the U.S. economy, this is a concerning sign. A huge dip in consumer spending could mean serious problems for the U.S. economy and its negative effects could bring fear and turmoil into the stock market. Hope you’ve found this week’s insights interesting and helpful.

Stay tuned for next Wednesday’s The Independent Investor! It’s a common mistake to assume that someone else has done all the necessary research. Learn more about why you should be your own “Devil’s Advocate” in next week’s article! |

Miles Everson

CEO of MBO Partners and former Global Advisory and Consulting CEO at PwC, Everson has worked with many of the world's largest and most prominent organizations, specializing in executive management. He helps companies balance growth, reduce risk, maximize return, and excel in strategic business priorities.

He is a sought-after public speaker and contributor and has been a case study for success from Harvard Business School.

Everson is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants and Minnesota Society of Certified Public Accountants. He graduated from St. Cloud State University with a B.S. in Accounting.