This one theory could reframe the tax debate!

| From the desk of Miles Everson: Happy Wednesday! Welcome to today’s edition of “The Independent Investor.” In these articles, I publish thought pieces in hopes of helping you make wise decisions in terms of finance and investing. For this article, allow me to share with you my friend and colleague, Professor Joel Litman’s insights about taxes. Continue reading below to learn more. |

This one theory could reframe the tax debate! Some of the loudest alarm bells in Washington aren’t coming from political opponents or activist groups—they’re coming from inside the Republican Party itself. … but before we dive into politics, let’s first talk about something much more dangerous: A widespread misunderstanding of how money moves through the U.S. economy . This isn’t just a theoretical problem; it’s a USD 5.5 trillion misunderstanding that could shape—or misshape—America’s financial future. … and according to Professor Joel Litman, Chairman and CEO of Valens Research and Chief Investment Officer of Altimetry Financial Research , the real issue isn’t about slashing budgets or ballooning deficits. The issue is misreading the numbers entirely.

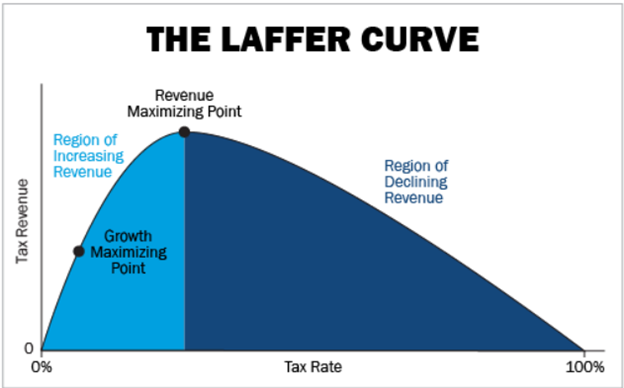

The buzz follows President Donald Trump’s administration making the 2017 tax cuts permanent through the One Big Beautiful Bill Act (OBBBA)—a move that meant an additional USD 5.5 trillion in tax relief over the next decade. The Act has triggered unease, as some fiscally conservative Republicans are worried such massive cuts could further expand the already towering federal deficit. However, Professor Litman argues that this concern, while understandable, misses a fundamental economic truth: Lower tax rates don’t always lead to lower tax revenue. In fact, they often do the opposite . Professor Litman points to a powerful and often misunderstood concept: The Laffer Curve . The theory maps the relationship between tax rates and tax revenue. It shows that after a certain point, higher tax rates actually discourage economic activity, while lower tax rates stimulate growth. That growth then generates more taxable income, ultimately increasing revenue.

In essence, when you reduce overly burdensome taxes, people and businesses are incentivized to work, invest, and expand… and when the economy grows, so does the government’s slice of the pie—even if the percentage is smaller. According to Professor Litman, this isn’t just theory; it’s also backed by 50 years of U.S. fiscal history. Proof in the Profits Professor Litman lays out the data clearly: Since the 1970s, every time the U.S. has cut corporate tax rates, tax revenues have increased within just a few years. … and yes, it’s not magic—it’s math! Corporate tax cuts unlock capital, allowing businesses to hire more, expand faster, and earn more. That growth gets taxed again in other ways: Through employee income taxes, capital gains, sales taxes, and more.

This kind of economic domino effect can have real impact—not just on Wall Street, but also on Main Street. It suggests that the USD 5.5 trillion in tax cuts feared by deficit hawks may actually help reduce the deficit over time, not worsen it. One of the biggest myths Professor Litman sees circulating in political debates is the idea that the only responsible response to tax cuts is slashing government spending. While fiscal prudence matters, he argues that an overemphasis on cuts—especially at a time when the economy is vulnerable—can choke off recovery before it begins. Instead, what’s needed is a strategic mindset shift: Focus on economic expansion, not immediate austerity . Professor Litman believes that President Trump’s tax strategy, if implemented effectively, could lead to higher corporate earnings, a robust job market, and ultimately more revenue flowing into federal coffers. Playing the Long Game For investors, this is actually a GOOD thing. According to Professor Litman, periods following tax cuts have historically led to strong stock market performance, especially for sectors most affected by corporate profitability. He advises investors not to get caught up in the noise of deficit debates, but instead to look at the long-term earnings trajectory of businesses likely to benefit from more capital and less tax drag. While USD 5.5 trillion in tax relief may seem like a budgetary black hole, it could in fact be a launchpad for growth, both in the economy and in investment returns. There’s more… Continuous feedback from early adopters also fueled refinements in subsequent models, demonstrating a commitment to innovation. With each new iteration, Samsung addressed concerns related to durability, screen creases, and user interface improvements. As a result of this iterative approach, the company was able to build trust and credibility in the market, ensuring that foldable smartphones were not just a passing trend but also a lasting innovation. In the end, the question isn’t: “How much will the government lose?” AIt’s actually: “Who’s going to win—and how can I position myself accordingly?” Hope you’ve found this week’s insights interesting and helpful. Stay tuned for next Wednesday’s The Independent Investor! This person, who runs an executive coaching business in Londo thought she had a safe bet… until her savings got wiped out. Learn more about what you should do best with your money during a bull run in next week’s article! |

Miles Everson

CEO of MBO Partners and former Global Advisory and Consulting CEO at PwC, Everson has worked with many of the world's largest and most prominent organizations, specializing in executive management. He helps companies balance growth, reduce risk, maximize return, and excel in strategic business priorities.

He is a sought-after public speaker and contributor and has been a case study for success from Harvard Business School.

Everson is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants and Minnesota Society of Certified Public Accountants. He graduated from St. Cloud State University with a B.S. in Accounting.