Get ready! Small stocks are preparing for their BIG moment! [Wednesday: The Independent Investor]

| From the desk of Miles Everson: Hello, happy Wednesday! I hope you’re all doing well wherever you are, or whatever you’re doing right now. For today’s article, I’m happy to feature yet another useful investing insight from my friend and colleague, Professor Joel Litman. For me, it’s important for us to know this because it will truly help us make wise decisions in our investments. Let’s focus on stocks for today’s topic. Continue reading below to better understand what Professor Litman is saying about this subject. |

Get ready! Small stocks are preparing for their BIG moment! You don’t notice the quiet ones until the noise fades. In a market obsessed with scale, speed, and dominance, the spotlight often never shifts away from the giants… until something subtle begins to stir beneath the surface. Hidden among the headlines of trillion-dollar tech companies and surging indexes, a quiet transformation is underway. According to Professor Joel Litman , Chairman and CEO of Valens Research and Chief Investment Officer of Altimetry Financial Research , it might just be the beginning of a new era for investors willing to look where few others are looking. In fact, he recently shared a compelling perspective: While Wall Street has been enamored with the S&P 500’s titans, the real opportunities may lie with the underdogs . Small- and mid-cap stocks, long overshadowed by their larger counterparts, could finally be ready for their moment. In fact, he recently shared a compelling perspective: While Wall Street has been enamored with the S&P 500’s titans, the real opportunities may lie with the underdogs.

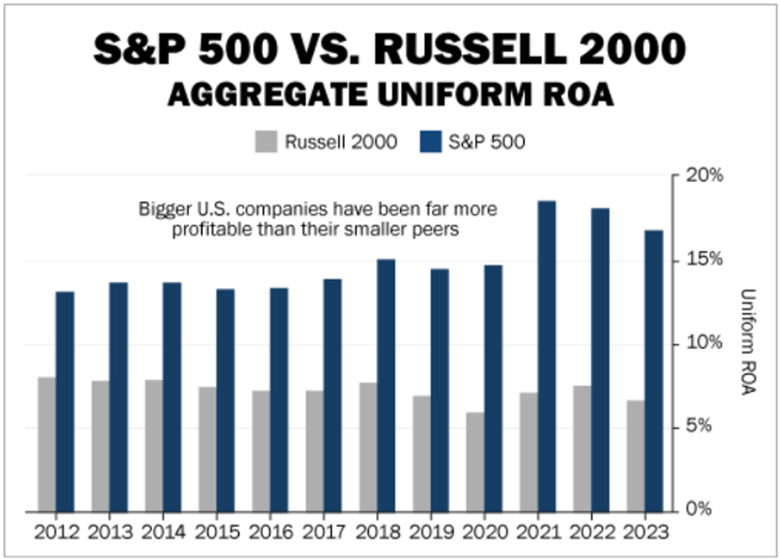

America’s Corporate Powerhouse and Its Growing Divide There’s no denying the muscle of U.S. corporations. From revenue to profitability and return on assets (ROA), American companies dominate. As a matter of fact, the most recent Fortune Global 500 rankings states the U.S. reclaimed the top spot with 139 companies—surpassing China’s 128 after years of neck-and-neck competition. What’s more? These aren’t just the most numerous corporations; they’re also the most efficient, profitable, and globally influential. A recent study from the Center for Strategic and International Studies confirmed that U.S. companies, on average, boast the highest ROAs in the world. Switzerland, the next-best, trails by an entire percentage point. Professor Litman points out that this dominance has also widened the gap between large-cap leaders and the rest of the corporate field. The S&P 500, heavily weighted with America’s elite companies, reflects that reality. Its aggregate Uniform ROA, a metric that Professor Litman’s team pioneered for truer economic insight, has surged from around 12% in the early 2000s to as high as 19% in 2021 and a still-robust 17% in 2023. These companies leverage their size for unmatched advantages: Investing in innovation, scaling with cost efficiencies, and locking in industry dominance . No wonder they’ve captured the lion’s share of investor attention and capital! Here’s the thing: What happens outside that spotlight? The Russell 2000, a benchmark of small- and mid-cap companies, tells a different story. Unlike the S&P juggernauts, these smaller firms don’t have the same financial firepower or global positioning. Many are even scrappy, regionally focused, and operating with thinner margins. Their Uniform ROA paints a stark picture. It peaked at just 8% in 2006 and has since declined to a mere 7%. While the S&P’s profitability has soared, these companies have struggled to maintain ground, let alone advance.

As Professor Litman explained, they’re fighting uphill battles against rising costs, global competitors, and shrinking market share. The upside? Litman doesn’t see this as a reason to dismiss such stocks or companies. In fact, it’s quite the opposite… A Tipping Point for Transformation Professor Litman believes the struggle of small-cap stocks is nearing a turning point… and savvy investors should start paying close attention. According to him, the policy landscape is shifting, especially with the economic agenda of President Donald Trump. While many in the market focus on the noise of politics, Professor Litman focuses on the potential implications for American industry. Quick recap: Trump’s plans include tariffs on Chinese imports aimed at boosting competitiveness for the U.S.-based firms, especially those under pressure from cheaper overseas alternatives. According to Professor Litman, this isn’t just about trade; it’s also about leveling the playing field for companies that have been systematically squeezed. … and when those pressures lift, some of these smaller names are positioned to explode in value. This doesn’t mean throwing a dart at the Russell 2000 and expecting returns, though. Professor Litman is clear: Not all small stocks are created equal . Some are still burdened with weak fundamentals, broken business models, or minimal exposure to tailwinds like deglobalization and supply chain reshoring. Meanwhile, others—particularly those with strong operational efficiency, unique value propositions, and domestic growth catalysts—are at a critical inflection point. These are the companies that could rise fast when macro conditions shift in their favor. To uncover these breakout candidates, Professor Litman advocates for a deeper, more forensic level of financial analysis —one that strips away accounting distortions and uncovers true profitability and risk. That’s where the Uniform Accounting framework comes into play. This method recalibrates financial statements to better reflect economic reality… and it’s the secret sauce behind many of Professor Litman’s most accurate calls. A Market Waiting to be Seen For investors and asset managers accustomed to the comfort of the mega-cap machine, this thesis requires a mindset shift. After all, it’s easy to bet on winners that have already won. However, as Professor Litman has emphasized throughout his career, the biggest gains come from identifying change early, before the market prices it in. Right now, those gains could be hiding in companies most investors are ignoring. Professor Litman’s message to the investing community is clear: Don’t sleep on the small caps . The conditions are ripening. The policy winds are changing… and for the first time in years, the stage may be set for a MASSIVE revaluation. As he often reminds his audience: The best opportunities rarely come with a spotlight. So, you have to know where to look . Hope you’ve found this week’s insights interesting and helpful. EXCITING NEWS AHEAD The world of work has shifted, and there’s no going back. The barriers to entry have never been lower for talented professionals to work independently, and today’s massive external workforce is hardly a pandemic-produced fad. Business owners can only survive in the new work landscape by partnering with this deep talent pool. With decades of experience in both small-business entrepreneurship and executive management at PwC, I truly believe that the future of work is independent. With that, I’m happy to share with you that my book, co-authored with Walter Scott Lamb, is now available on Amazon! Free Birds Revolution: The Future of Work & The Independent Mind This new bestseller is an essential read for both independent professionals and corporate executives. Here, we provide educational and practical guides to unpack the ever-growing workforce and offer you crucial ways to become a client of choice. Click on the link above to order your copy. Let this bestselling book help you future-proof your career and organization in the new world of work. Stay tuned for next Wednesday’s The Independent Investor! It has always been assumed that population size is directly proportional to its output. Learn more about why tax policy matters in next week’s article! |

Miles Everson

CEO of MBO Partners and former Global Advisory and Consulting CEO at PwC, Everson has worked with many of the world's largest and most prominent organizations, specializing in executive management. He helps companies balance growth, reduce risk, maximize return, and excel in strategic business priorities.

He is a sought-after public speaker and contributor and has been a case study for success from Harvard Business School.

Everson is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants and Minnesota Society of Certified Public Accountants. He graduated from St. Cloud State University with a B.S. in Accounting.