This is why simply sitting on cash WON'T make you rich (unless you're Warren Buffett)…

| From the desk of Miles Everson: Happy Wednesday! I hope you’re doing well. Today, I’m excited to share with you a useful investment insight from my friend and colleague, Professor Joel Litman. I believe this is something that will truly help us excel in the field of investing. Are you ready? Keep reading the article below. |

|

This is why simply sitting on cash WON'T make you rich (unless you're Warren Buffett)… Most investors idolize Warren Buffett, aspiring to replicate his success in the stock market. Who wouldn’t, right? After all, his track record at Berkshire Hathaway is legendary, consistently outpacing the S&P 500 since 1965. … but did you know that despite being one of the richest men on Earth, Buffett is NOT someone you would—or should—want to imitate, especially when it comes to market timing ? Yes, you read that right. As Professor Joel Litman , Chairman and CEO of Valens Research and Chief Investment Officer of Altimetry Financial Research, emphasized in a recent discussion, mimicking Buffett’s approach may not be the wisest strategy for most investors. Here’s why… Buffett Has A Habit of “Throwing In The Towel”

Buffett is undeniably one of the greatest investors of all time, but even he acknowledges that timing the market is not his strength. Historically, when stock valuations reach extreme highs, he tends to step back, accumulating cash rather than making aggressive investments. Currently, Berkshire Hathaway is sitting on an unprecedented USD 350 billion in cash, a move that many interpret as a signal that the market may be overvalued. This isn’t the first time Buffett has taken such a position. During the dot-com boom of the late 1990s, he famously avoided technology stocks, citing a lack of understanding of the industry. At the time, Berkshire held a then-record USD 9 billion in cash, missing out on substantial gains before the market eventually corrected. Today, the market is experiencing similarly high valuations, with the S&P 500 trading at a 25 times Uniform price-to-earnings (P/E) ratio. Inflation remains moderate by historical standards, and corporate tax rates are still favorable, creating conditions for sustained high valuations. Yet, Buffett is once again staying on the sidelines. Professor Litman argues this approach is NOT suitable for most investors. Unlike Buffett, who has the luxury of sitting on billions of dollars, individual investors and institutions must remain more tactical in their market participation. Instead of following Buffett’s lead and retreating from the market, Litman highlights the importance of identifying stocks with strong fundamentals that are still worth owning, even in an expensive market. One of the key strategies Litman advocates is the concept of “Perfect Stocks.” This approach, developed through a collaboration between Valens Research and corporate affiliate Chaikin Analytics , merges deep fundamental research with advanced stock-picking software. By using this strategy, investors can pinpoint high-quality stocks and determine the optimal timing for their purchase. Back-testing this approach has yielded impressive results for Professor Litman and his team. The “Perfect Stock” strategy has historically identified stocks that doubled in value, soared 160%, and even skyrocketed nearly 800%, particularly during periods of political and economic uncertainty. Given the current market conditions, Professor Litman and his team believe that another major opportunity is emerging—one that could generate significant gains for those positioned correctly. A Luxury That Not Many Can Afford With uncertainty over tariffs, various geopolitical tensions across the globe (Israel vs. Iran and Palestine, Russia vs. Ukraine, and China’s geopolitical tensions in the South China Sea), and market valuations at elevated levels, the risks and rewards in the stock market are higher than ever. According to Professor Litman, investors cannot afford to sit idly by, as many stocks remain highly overvalued and could experience sharp declines. Instead, investors should strategically select the right stocks at the right time so they can capitalize on emerging opportunities while avoiding costly pitfalls. The key takeaway here? While Buffett’s cautious approach works for himself personally, most investors cannot afford to follow the same path. By staying informed, using data-driven strategies, and remaining proactive, you can set yourself up for success in an ever-evolving market landscape. Hope you’ve found this week’s insights interesting and helpful.

Stay tuned for next Wednesday’s The Independent Investor! AI may have provided countless benefits for society. But it has also turbocharged threats to cybersecurity. Learn more about this cautionary tale from the U.S. healthcare system in next week’s article! |

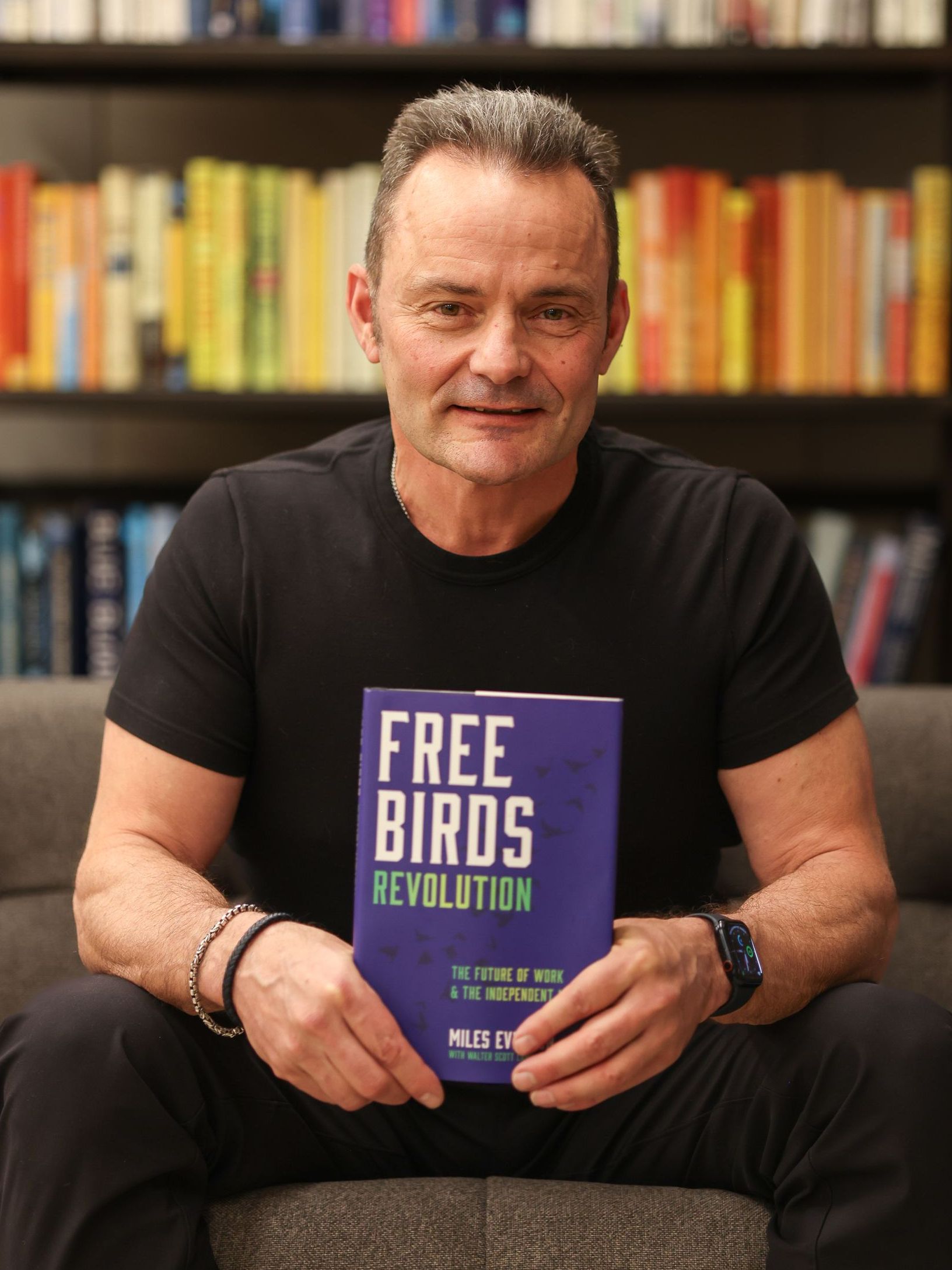

Miles Everson

CEO of MBO Partners and former Global Advisory and Consulting CEO at PwC, Everson has worked with many of the world's largest and most prominent organizations, specializing in executive management. He helps companies balance growth, reduce risk, maximize return, and excel in strategic business priorities.

He is a sought-after public speaker and contributor and has been a case study for success from Harvard Business School.

Everson is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants and Minnesota Society of Certified Public Accountants. He graduated from St. Cloud State University with a B.S. in Accounting.